The Ultimate Guide To Investment Advisors

Table of ContentsThe Buzz on Investment AdvisorsThe Best Guide To Investment Advisors

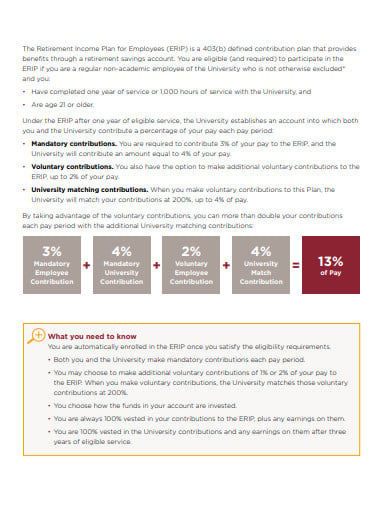

One usual mistaken belief is that retirement accounts are assured. Sadly, this is actually not the case. While some plans provide insurance for pension, including the FDIC for interest-bearing accounts as well as the SIPC for brokerages, these courses only secure versus loss as a result of to failing of the company, certainly not against reduction because of market conditions. Several consider their 401( k)an assured retirement discounts program. But however, that isnot the situation. A 401 (k)is actually an employer-sponsored retired life profile that allows workers to add a section of their income to a tax-deferred account. investment advisors. The cash in the profile can easily at that point be actually purchased different securities, such as equities, guaranties, as well as shared funds. The profile worth are going to rise and fall relying on the efficiency of the financial investments. For these explanations,

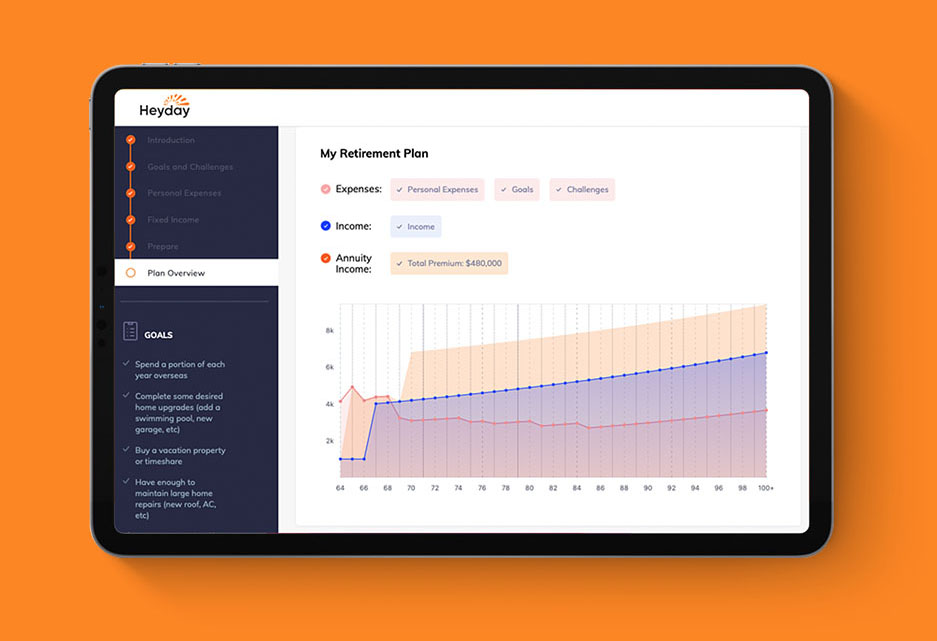

it is important to comprehend that a 401 (k)is actually not an assured retirement life consideration. It can easily still be actually an important tool for creating your home egg. Pensions are actually often ignored as retired life planning tools, yet they provide many special advantages that could be incredibly valuable to senior citizens. Second, pensions are actually tax-deferred, so you will definitely certainly not possess to pay out normal income tax obligation on your expenditure up until you acquire repayments. Allowances supply fatality perks and also spousal benefits that can help to provide monetary protection for your enjoyed ones. For these factors, pensions are typically looked at one of the most safe and secure retirement. Nonetheless, if you are actually searching for a risk-free expenditure profile that are going to supply a surefire profit flow, an allowance along with a life time revenue cyclist is the method to go. With this form of allowance deal, your payments are actually ensured regardless of how long you live, so you may rest guaranteed that your retirement cost savings will never ever run out. Using this kind of allowance, your rate of interest is assured for a collection amount of time, so you understand exactly just how much loan you'll gain yearly. Finally, if you are actually seeking an investment that has the possible to develop over time, a predetermined mark annuity is the best option for you. Index pensions do certainly not shed funds to market volatility and ought to certainly not be actually perplexed along with a changeable allowance (which can lose money ).

Everything about Investment Advisors

Among the most ideal ways to guarantee a comfortable retirement is actually to acquire an annuity. Predicting just how much cash you will definitely need to have to barring retirement may be tricky, however our can easily provide you a really good idea of what you'll need to have to have actually allocated. As soon as you understand just how much you need to have to spare, you may begin acquiring a pension and appreciate the comfort that features understanding you possess a consistent profit stream in retired life. Find out exactly how to prepare and barring retirement life in your twenties, thirties, forties, fifties, and sixties. Don't create the mistake of taking SSI early. Put off benefits until the total Social Security old age or age 70. A decrease in advantages will influence a specific later on in life when long-term treatment is actually required. Furthermore, non-qualified allowances are cashed by already taxed money, and also just additional info the rate of interest earned will definitely be taxed when you generate profit throughout retirement - investment advisors. The consensus is that tax obligations will only enhance later on. Much higher tax obligations result in less earnings for the senior citizen. A non-qualified pension minimizes this risk reviewed to a standard individual retirement account or even individual retirement account pension considering that simply the enthusiasm is exhausted as opposed to the whole amount. Connect with our company today for a quote if you have an interest in discovering even more regarding annuities. We would certainly be happy to go over the choices offered and aid you locate the very best remedy for your needs. Thanks for checking out! Acquire help coming from an accredited financial expert. This company is actually at no cost. A pension is an insurance coverage product that can easily give a flow of payments for a set time period or even the remainder of your lifestyle. When you purchase an annuity, you spend a clump sum, and also the releasing insurer accepts to create regular repayments to you, either for a set duration or for just as long as you reside. For several workers, a traditional pension planning is actually necessary to their retired life preparation. These workplace individual retirement account make use of an allowance agreement to give lifetime profit to retired laborers. Pension plan benefits can easily be actually an essential retirement earnings source, as well as conventional pension programs are frequently among the best reasonable revenue sources offered. Around this aspect the majority of our company have counted on a steady, step-by-step paycheck from our company every 2 full weeks or even each month. Our perks were actually instantly subtracted, and also our finances might quickly be actually prepared for. This is still achievable in retirement, yet it requires some foundational work to develop these self-paid salaries for the rest of our lifestyle. There are actually an amount of concerns that need to have to become responded to when you're planning retired life revenue. 1)Calculating when to retire is actually a key think about intending your retired life income. While this concern may certainly not be actually very easy, it is essential to examine each of the a variety of aspects to give you why not check here the opportunity of the most ideal see here retirement life feasible. Duration Certain This option allows you to acquire a repayment for an established lot of years.